How To: Budget in High School

My personal method for creating a budget.

Budgeting is a word that scares even the most organized young adult. Scraping together a couple of dollars for Taco Bell may not be a reality for you now, but at some point, it might.

Almost everyone meets a time in their life where saving money is essential. If this is your current situation, don’t panic! You’re not alone, and chances are people around you are going through the same struggle. I know what it’s like to count quarters to pay for gas, but it doesn’t always have to be that way. If you have any source of income, you can make a budget plan for yourself that will allow for successful money saving.

Steps to building your budget:

1. Decide how much of your budget you plan on putting into savings.

“Pick a percentage of money you would like to put away and stick to that percentage,” stated sophomore Adam Fisher.

This advice is key in terms of saving money. It also allows you to avoid having to adjust depending on paycheck size. Personally, I use a 20% savings rate to start. It helps you keep your head above water for those smaller paydays, but also forces you to put some aside on those checks that you just want to spend and spend with. You don’t have to have a specific thing you want to spend your savings on. You can plan a big goal, or you can make small ones here and there. For whatever purpose, putting money into savings is a smart thing to do when you have any sort of income.

2. Evaluate any recurring expenses that come up in your monthly spending.

This could be any subscriptions you have or any consistent payments that you have to keep up on such as insurance or phone payments.

Freshman Hunter Hopkins stated, “Make sure get the things you need before you get the things you want.” This is important to remember when choosing where the base of your money will go.

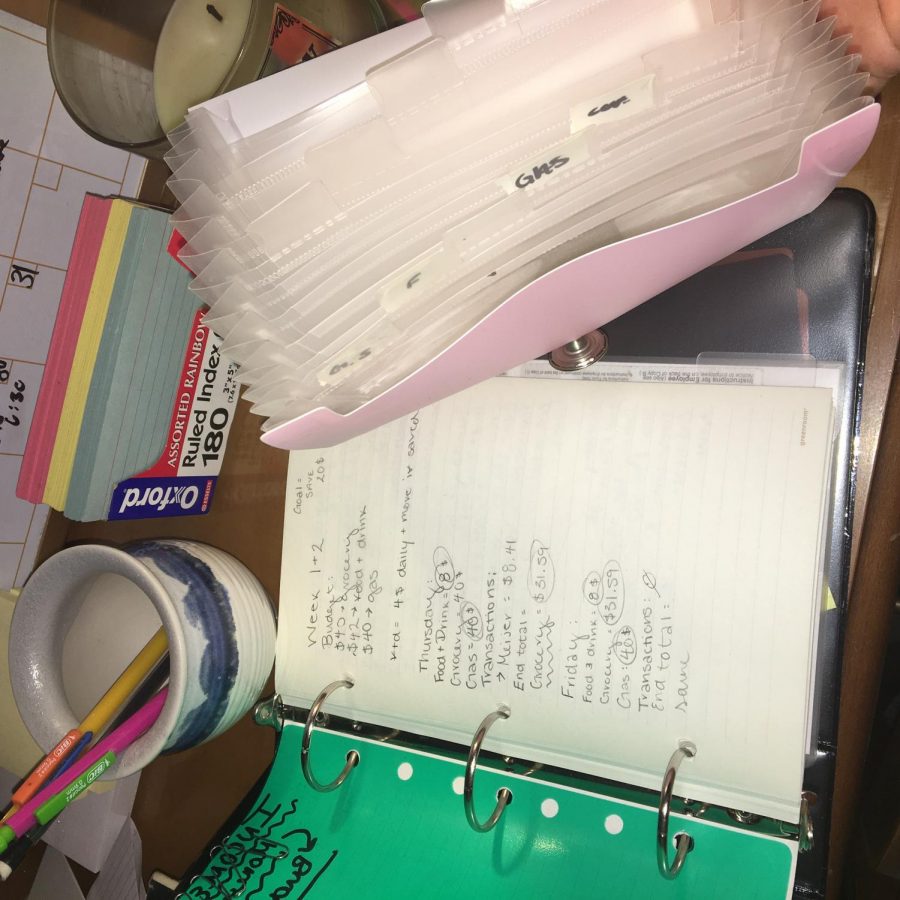

3. Separate the rest of your everyday expenses into various categories.

For example, gas, food and drink, entertainment, etc. This one is mainly a judgment call. You’re responsible for putting the least amount of money possible in each category in order to ensure that you don’t have to take money from anywhere else in order to cover other sections. This is also where organization comes into play. This may include different methods that fit whatever style you prefer.

“I have an envelope that is blank, and each time I get any money I set aside ¼ of whatever it is. This way, whenever I need money I have it,” said freshman Nevada Thomas.

4. Stay on top of things!

Sticking to a budget is hard, but with the right amount of determination, anyone can do it. A very beneficial factor is keeping your money separated and organized. The money needed for recurring expenses and savings should be separated from your spending money. Keeping this consistent will allow you to see where your money is going and prevent you from overspending in an area in which you didn’t mean to. Keeping your savings somewhere you can’t get to them is also something to look into. This could be something as simple as a safe in your bedroom or a savings account at the bank.

Budgeting allows you to stay organized with the money you’re earning and can help you to avoid spending it on silly things you don’t necessarily need. Choosing to save money now can help start healthy spending habits for the rest of your life. Because while today 5$ might not seem like a lot of money, you might meet the day where it’s everything.

McKaley is a senior in her third year of journalism and is in her second year of serving as website manager. She is also a section leader and a member of the leadership committee for choir. She lives off of coffee and her infinite love for cats. In the impending future, she plans on going to UC Blue Ash for criminal justice.